"THE NARLO CHRONICLES" For the week of: The "In Defense of Rural America" column archives are available HERE. - - - - - - - - - - - - - - - - - - - - To order over 200 of Ron Ewart's articles on a USB Flash Drive dating back over 4 years, click HERE - - - - - - - - - - - - - - - - - - - - "How To Poke the IRS in the Eye and Win" - - - - - - - - - - - - - - - - - - - - Since the ink was dry on the 16th Amendment (1913) from which the Federal Reserve and the Internal Revenue Service (IRS) were born, controversy and confusion have surrounded both "breach" births, but none more than the IRS. From arguments about whether the 16th Amendment was constitutionally ratified by Congress and the states, to whether the Internal Revenue Code (IRC) legally applies to all American citizens and whether their income is legally taxable, continue to swirl around the country. A few names of IRS deniers come to mind: Tommy Cryer (deceased), Pete Hendrickson, Irwin Schiff, (in jail) Otto Skinner and Paul A. Mitchell, (arrested) to name a few. Books and scholarly treatises by these and other authors have been written about these issues and thousands of Americans have acted on the information in those books and treatises, however most to their own detriment. Incidentally, Irwin Schiff's book, "The Federal Mafia" is now banned here in the land of the free!!! You very seldom win every battle in a war. And that was surely true in this case. The man did not win all of his battles with the IRS. His 10 years of "zero" tax returns, ala Pete Hendrickson and "Cracking the Code", were ruled frivolous and the IRS started collection proceedings against the man's wife by garnisheeing her paycheck. Nevertheless, the man won a huge victory against the IRS in their "Summons Enforcement" case, operating as his own attorney. As stated earlier, he is a paralegal and he had done some significant legal research in order to prosecute his case against the government. If you want to learn more about how this man "Poked His Finger in the Eye of the IRS and Won" and read some of his writings, we invite you to click "HERE". We have purposely omitted this man's name and location to save him from any further retaliation by the IRS but we can assure you that this story is absolutely true. Exhausted from this battle, the man relayed the following to us at the end of the interview: - - - - - - - - - - - - - - - - - - - - - - - - - -

Ron Ewart, a nationally known author and speaker on freedom and property issues and author of his weekly column, "In Defense of Rural America", is the President of the National Association of Rural Landowners, (NARLO) a non-profit corporation headquartered in Washington State and dedicated to restoring, maintaining and defending property rights for urban and rural landowners. He can be reached by e-mail for comment at info@narlo.org or by 'phone at 1 800 682-7848. - - - - - - - - - - - - - - - - - - - - - - - - - -

COMMENTS: Should you desire, you can e-mail a comment to this article at: comment@narlo.org. Worthy, thoughtful comments, in our sole discretion, will be posted below the article. Comments that use foul language, pejoratives, or attacks against others will be discarded. Be sure to include your full name, as blind e-mail comments will not be posted.

- - - - - - - - - - - - - - - - - - - - COMMENTS:

By Ron Ewart, President of the

NATIONAL ASSOCIATION OF RURAL LANDOWNERS

Sunday, June 14, 2015

From * The NARLO Chronicles *

By Ron Ewart, President

National Association of Rural Landowners

and nationally recognized author on freedom and property rights issues.

We are helping to spread freedom and liberty around the globe.

© Copyright June 14, 2015 - All Rights Reserved

Pete Hendrickson of Michigan, authored one of the most controversial books written about the IRS. His book was entitled "Cracking the Code". The argument in Pete's book is that a strict and literal interpretation of the IRC shows, without a doubt, that the only people taxable are those that work for the government and some foreigners. This is an oversimplification of what is said in the book but Pete goes on to show that those who have paid taxes to the government can get a refund for previous taxes paid by filing a "zero" income tax return. We won't go into the merits of Pete's arguments and methods here, but suffice to say, thousands of Americans have followed Pete's advice and filed "zero" income tax returns. Sadly, most have been hit with filing a "frivolous position" with the IRS and have been heavily penalized. Even Pete and his wife have suffered greatly at the hands of the IRS and the Department of Justice and right now Pete's wife just went to jail for 18 months because she refused to sign a U. S. Federal Court-IRS-DOJ generated stipulation agreement they shoved in her face and said sign or else.

One of those individuals that acted on Pete's advice filed 10 years of "zero" income tax returns and then sat back and waited for his refund. He would have a long wait. Being an incurable maverick this individual wrote a guest editorial to his local newspaper highly critical of America's most infamous collection agency but refused to name that agency in the article. There was no need to name it, since every sane, breathing adult in America knows its name and lives in terror of its vicious wrath.

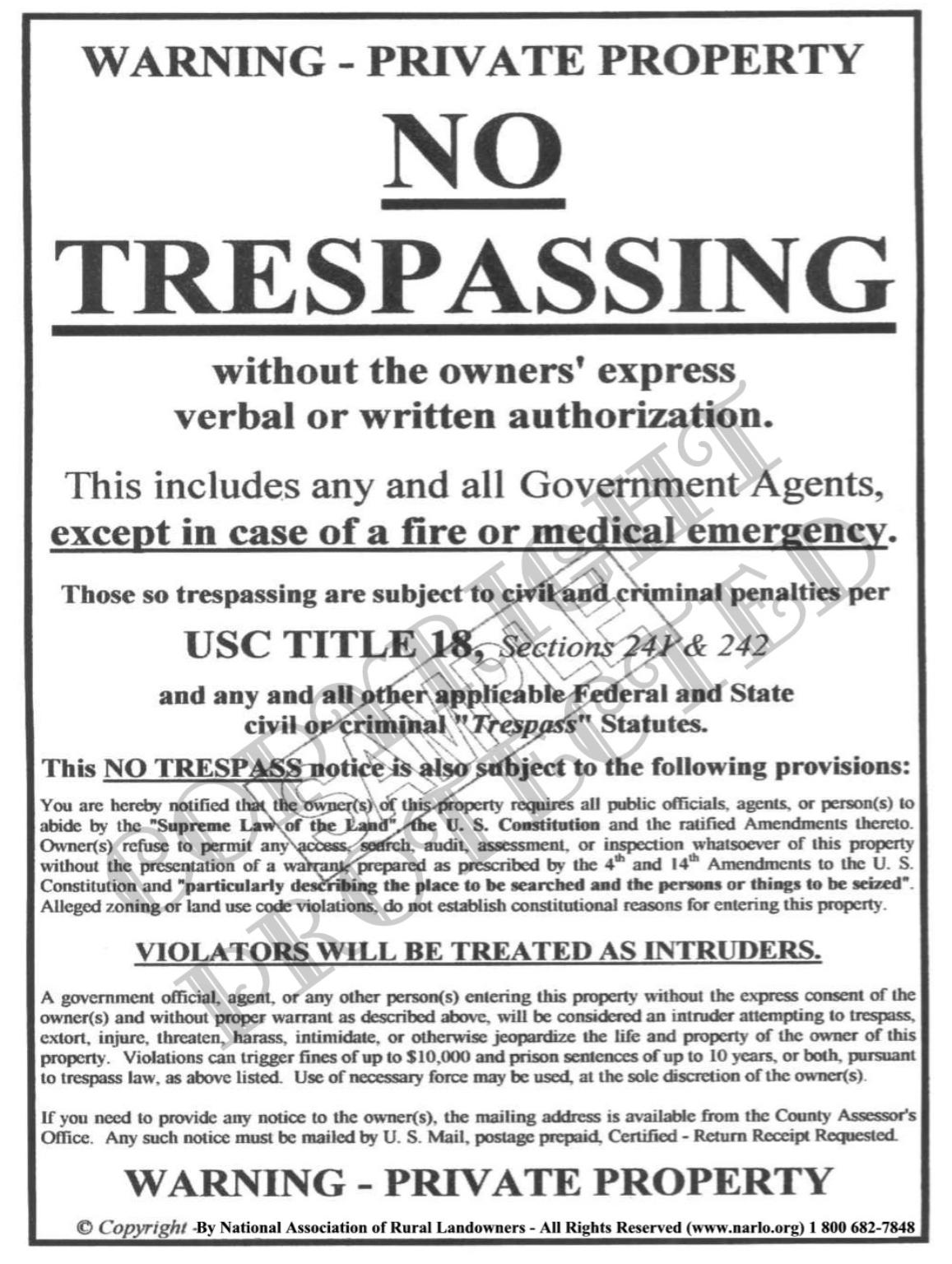

Well you can guess that this unnamed agency took great exception to what this individual wrote and quickly sent out an IRS agent in person to the man's front door to harass the individual and eat out his substance." In fact, the IRS agent handed the man a "Collection of Information Statement for Wage Earners" and strongly suggested that the man fill it out and send it to the local IRS office at once ….. or else. The man told the IRS agent to never set foot on his property again. The agent snapped back "Oh yea! What will happen if I do?" The man calmly told the agent he would be treated like any common trespasser.

Obviously, this set the IRS wheels in motion to take the man down ….. any way they could, especially since he had filed 10 years worth of "zero" income tax returns, ala Pete Hendrickson, as instructed in Pete's book "Cracking the Code." Shortly after the IRS agent visited the man at his home, the man was served with a summons to appear in U. S. District Court. The charge was "Failure To Fill Out the 10-Page Collection of Information Statement for Wage Earners."

Oh, but the man did fill out the form. On every question but one, the man declared his 5th Amendment privilege to not incriminate himself. Lois Lerner got away with it and we do mean she "really" got away with it. To give you an insight into the obstinate character of the man, one of the questions on the form asked if the person filling out the form was going to receive any future income. The man answered thusly: "I expect a huge sum of money to come in right after I sue the crap out of the IRS and the DOJ."

In one of this man's speeches, he stated with pride that "I am a certified paralegal with 13 years experience in the state and federal courts, and I have been labeled an 'illegal tax protestor.' I am very proud of this label since I have decided that for the rest of my life, I will protest each and every illegal tax that I am asked to pay. This country was founded upon protestation of illegal taxes, and I am honored to carry on the tradition."

At the beginning of the court case, and throughout the case, the IRS agent and the Department of Justice (DOJ) attorney prosecuting the case had sworn up and down, in writing and under penalty of perjury, that the man and his wife had not filed several years of tax returns and that the collection-of-information form was therefore needed in order to figure out the man and his wife's tax liabilities. The man then received a letter from a different IRS office stating that their jointly filed tax return had been selected for 'examination'. The man immediately filed an Affidavit of Probable Cause against the IRS agent and DOJ attorney prosecuting the case asking that they be charged with perjury. But given that the federal courts are just arms of the federal government, the judge ignored the man's affidavit.

Now the strange twist in the case is the IRS and DOJ initially went after the man's wife and did not name the man in the original pleadings. (Like the cowards they are, these guys go after the "soft underbelly" first and they make mistakes all the time) So the man filed a 'Motion to Dismiss For Failure to Include an Indispensable Party' as per FRCP 12 (b) (7), the indispensable party being the man who lives in a 'community property' state. The man was never granted a hearing on this motion and the court summarily denied it. However, when the early pleadings are compared to the final order for dismissal, the man's name magically appears. This is called "judicial slight of hand" that only a government attorney, or some judge on the take, can exercise.

But putting all the gory court details aside, the man delivered the coo de gras to the court with an "Affidavit of Truth" on February 26, 2008. For three years the case went silent and then on February 23, 2011 the IRS and DOJ attorney moved to dismiss the "Summons Enforcement Action" against the man because "the information had grown stale." Hardly! The government dismissed the case because the issue of "jurisdiction", so eloquently argued in all of the man's pleadings and in his final "Affidavit of Truth", had stopped them cold. For the IRS to let this case whither and die can only be explained by the power of the man's "jurisdiction" argument.

The controversy of "jurisdiction" permeates the Internal Revenue Code and other applicable law. There is currently a case before the U. S. Supreme Court, "ON PETITION FOR WRIT OF CERTIORARI TO THE UNITED STATES COURT OF APPEALS FOR THE FIFTH CIRCUIT", which covers the issue of jurisdiction eloquently and in detail. We have uploaded this WRIT to our website "HERE". Look on the page for "JURISDICTION - TROWBRIDGE - WRIT OF CERTIORARI." It is well worth reading for those who have an interest in this particular argument, as it relates to the IRS. At this writing, we do not know whether the Supreme Court has agreed to review the case. If the Supreme Court does agree to review it, a decision out of the court in favor of the Petitioner could blow the issue of jurisdiction, as it relates to the IRS, sky high.

"After the court case was dismissed, the IRS got my wife's employer to garnish her wages and send them nearly $40K over a period of several years. This was a very tough time for us, having to deal with the stress of a federal court action against us, then having our livelihood stolen. The effect of the stress on both of us has taken its toll on our health and psyche."

"Needless to say, we both suffered from 'legal abuse syndrome' and still spend every day looking over our shoulder. The fraud upon the court, perpetrated by the IRS, DOJ and the court itself, have left us exhausted, and very pessimistic about there being any real justice/non-violent recourse in our court system... the federal judicial system especially. I imagine most judges are as confused as anyone else about this rouge agency, and fear that they might be audited (God forbid) should they rule against them."

Yes, the man and his wife won in court, but at a significant cost, because the IRS is all-powerful and they never want you to forget it. However, the man told the IRS that he is not a "taxpayer" under Title 26 and other than the 10 "zero" returns, he hasn't filed a tax return in 17 years. Now that's courage!

Ladies and gentlemen, in interactions between an American citizen and the government, local, state, or federal, it boils down to the statements made by U. S. Supreme Court justices Holmes and Brandeis over 30 years ago where in an opinion they wrote:

“No distinction can be taken between the Government as prosecutor and the Government as judge.” 277 U.S., at 470. “In a government of laws,” said Mr. Justice Brandeis, “existence of the government will be imperiled if it fails to observe the law scrupulously. Our Government is the potent, the omnipresent teacher. For good or for ill, it teaches the whole people by its example. Crime is contagious. If the Government becomes a lawbreaker, it breeds contempt for law; it invites every man to become a law unto himself; it invites anarchy. To declare that in the administration of the criminal law [or IRS regulations] the end justifies the means – to declare that the Government may commit crimes in order to secure the conviction of a private criminal [or a taxpayer] – would bring terrible retribution. Against that pernicious doctrine this Court should resolutely set its face.” 277 U.S., at 485.

This basic principle was accepted by the Court in McNabb v. United States, 318 U.S. 332. There it was held that “a conviction resting on evidence secured through such a flagrant disregard of the procedure [or the law] which Congress has commanded cannot be allowed to stand without making the courts [or the government] themselves accomplices in willful disobedience of law.” 318 U.S., at 345.

If the IRS, or any government agency for that matter, can operate with impunity in violation of the law, or under the "color of law", then "the Government [is] a lawbreaker [and] it breeds contempt for the law and it invites every man to become a law unto himself, [in fact] it invites anarchy."

Just how far away are we from anarchy in America? From our perspective it is not very far. Government, at all levels, now considers itself to be above the law and the law has become ….. whatever government says it is, whether it's constitutional or not! A government in a nation of laws that rises above the law, or invents the law out of thin air, becomes an absolute monarchy of oligarchs. What is the peaceful solution? There is only one peaceful solution and that is millions of Americans rising up, en masse, in resistance to government, at all levels, and at every opportunity. Otherwise, there is only one other solution and it comes at a much greater cost with no guarantee of success.

DISCLAIMER: We make no warranties, express or implied, that the information presented in this article, or in any of the links shown herein, are accurate in all respects. It is the sole responsibility of the reader to verify the information for his or her own particular situation. The material provided is for information purposes only and there is no attempt by the author to provide legal or accounting advice to anyone whatsoever. If the reader acts upon this information, they do so at their own risk. Under no circumstances are we advocating that any American break the law, if it can be determined with any degree of accuracy, just what the law is.

© Copyright January 2015 by the National Association of Rural Landowners - All rights reserved.