"IN DEFENSE OF RURAL AMERICA" For the week of: The "In Defense of Rural America" column archives are available HERE. - - - - - - - - - - - - - - - - - - - - "Thousands of Small Internet Businesses On Thursday, June 21st, 2018, the U. S. Supreme Court delivered what could be a knockout blow to tens of thousands of small on-line sole proprietor retailers in America. The implications of this ruling could have far reaching consequences. (see High Court opinion: "Opinion" The High Court overturned their own 1992 decision in Quill vs. North Dakota that allowed on-line retailers to be exempt from state sales taxes as long as they did not have a physical presence in a particular state. Under the current decision, that exemption has been removed. Now, all on-line retailers, big and small, are subject to state taxes for sales within any state in America that levies state sales taxes. Small businesses, run by entrepreneurs, are the backbone of commerce and employment in America and they will continue to be unless we kill them off with too many regulations. The farmer and the rancher feed us. We can ill afford to drive them out of business. They need all the help we can give them.

- - - - - - - - - - - - - - - - - - - - - - - - - -

Ron Ewart, a nationally known author and speaker on freedom and property issues and author of his weekly column, "In Defense of Rural America", is the President of the National Association of Rural Landowners, (NARLO) a non-profit corporation headquartered in Washington State and dedicated to restoring, maintaining and defending property rights for urban and rural landowners. He can be reached by e-mail for comment at info@narlo.org or by 'phone at 1 800 682-7848. - - - - - - - - - - - - - - - - - - - - - - - - - -

COMMENTS: Should you desire, you can e-mail a comment to this article at: comment@narlo.org. Worthy, thoughtful comments, in our sole discretion, will be posted below the article. Comments that use foul language, pejoratives, or attacks against others will be discarded. Be sure to include your full name, as blind e-mail comments will not be posted.

- - - - - - - - - - - - - - - - - - - - COMMENTS:

a weekly column published every Sunday by

Ron Ewart, President of the

NATIONAL ASSOCIATION OF RURAL LANDOWNERS

Sunday, July 1, 2018

Could Be Forced To Close"

From * In Defense of Rural America *

By Ron Ewart, President

National Association of Rural Landowners

and nationally recognized author on freedom and property rights issues.

We are helping to spread freedom and liberty around the globe.

© Copyright July 1, 2018 - All Rights Reserved

It is not clear from the decision, at this point, that there are any sales threshold amounts that would exempt small on-line retail businesses from state sales taxes, with one exception. South Dakota, after the High Court ruling, did pass legislation that would exempt any business doing less than $100,000 in annual sales from the state sales taxes. Will other states follow? No one knows, leaving tens of thousands of small, sole proprietor businesses in a legal jeopardy. It's bad enough having to deal with one state and their sales taxes. But to deal with 44 other states is tantamount to administrative purgatory.

If you are running your own on-line retail business and are forced to deal with at least 44 states that have state sales taxes, the time necessary to fill out each state form and write a check and mail to each state would literally overwhelm a sole proprietor. Larger companies will be forced to hire one or more administrative personnel to manage the forms and taxes for each state.

Also, it is not just a matter of filling out a tax form and mailing in a check. The sales and business and occupation (B & O) tax regulations for the state of Washington are so voluminous as to make compliance almost impossible for a small business. Here is an example:

Sellers must post a conspicuous notice on the marketplace (platform, website, catalog, or any other similar medium) that informs Washington purchasers that:

1. Sales or use tax is due on certain purchases.

2. Washington requires the purchaser to file a use tax return.

3. The notice is required under RCW 82.13.020(2)(a)(i).

Sellers must provide a notice at the time of sale prominently displayed on the invoice/order form and on the receipt or similar document provided to the purchaser, whether in paper or electronic form. The notice must include:

1. A statement that neither sales or use tax is being collected or remitted upon the sale.

2. A statement that the Washington purchasers may be required to remit sales or use tax directly to the Department of Revenue.

3. Instructions for obtaining additional information from the Department of Revenue regarding whether and how to remit the sales or use tax to the Department.

Sellers must provide a report no later than February 28, 2019, and each following year to each purchaser for whom the seller was required to provide the invoice/receipt notice.

The report must provide:

1. A statement that the seller did not collect sales or use tax on the purchaser's transactions with the seller, and that they may be required to remit tax directly to the Department of Revenue.

2. A list, by date, generally indicating the type of product purchased or leased during the immediately preceding calendar year by the purchaser from the seller, sourced to Washington, and the price of each product.

3. Instructions for obtaining additional information from the Department regarding whether and how to remit the sales or use tax to the Department.

4. A statement that the seller is required to submit a report to the Department stating the total dollar amount of the purchaser's purchases from the seller.

5. Any additional information that the Department requires.

The burden on the on-line retailer to comply with this government-generated nonsense could be almost impossible without hiring additional staff. In most cases sole proprietors don't make enough revenue to afford hiring more people. They run on low overhead and their profit is mostly in their labor. They keep their administrative costs down by doing it themselves, usually late at night or on weekends. Many of them work 60 to 80 hours per week to keep their businesses going.

But what of the consumer/purchaser? Does he or she have an obligation to state taxes on purchases they make? You bet! Under Washington State law, as shown above, there is also a burden on the purchaser of which he or she knows absolutely nothing.

On an invoice in a recent purchase we found this notice:

"The Vermont Country Store is not required to and does not collect sales tax in Colorado, Kentucky, Louisiana, Oklahoma, Pennsylvania, Puerto Rico, Rhode Island, South Dakota, or Washington. Your purchase for delivery to these states is subject to sales or use tax unless the purchase is specifically exempt. Please note that there is no exemption from state sales or use tax based merely on the fact that a purchase is made over the Internet, by catalog, or by other remote means. The laws of these states require that a consumer's sales or use tax be paid annually on the appropriate tax forms."

When a customer purchases a product, they assume that the taxes are taken care of by the seller, so why would they study the law to see if they had a state tax liability? Even if they received the above notice, they wouldn't file a Use Tax form with the state, or pay the taxes. The above notice would just be ignored. The statute is essentially unenforceable.

Many small on-line retailers use Paypal to accept credit card payments. The Purchase Order from Paypal provides only the product, the purchase amount, shipping and handling and a sales tax if applicable. There are no provisions to put a notice, like the one shown above, on the Paypal Purchase Order, and the small retailer may not even put a paid invoice in with the product. As long as the customer receives the product they don't care if an invoice came with it.

Now multiply Washington State regulations by 44 other states that have state sales tax statutes similar to Washington's. It's not just overwhelming, it could be a deathblow to a small business.

Current estimates are that there are over 100,000 on-line retailers in America making over $12,000 per year in annual sales. The lion's share of those 100,000 on-line retailers, are small, one or two person businesses selling arts, crafts, antiques, hand made items and a variety of other products. Companies like Amazon and Ebay have the skill, capacity, staff, technical knowledge and funds to comply with these state regulations. Small businesses don't!

For over 30 years we developed raw land into acreage building lots. Each year, from the day we started, the regulations grew larger and more onerous. The cost of those regulations, the time required to finish a project and devastating market fluctuations grew exponentially until finally we were forced out of the business. We were not alone. Small developers and builders have slowly disappeared from the scene due to regulations and the cost of those regulations. Now, only the most well heeled and politically connected developers and builders can profit in this environment.

For 12 years we have operated a small business known as the "National Association of Rural Landowners." We are advocates for and sell useful products to rural landowners all over America on our website. The requirement to deal with at least 44 states, their sales tax forms and their endless bureaucracies, gives us a headache that won't go away. The new burden placed upon us by the new state tax rules just approved by the U. S. Supreme Court decision, will probably force us to raise our prices, which could drive away customers.

According to the U. S. Census Bureau, in 2010 there were 27.9 million small businesses in America. Only 18,500 firms (0.0663%) had 500 employees or more. Sole proprietors make up 73% of that 27.9 million. Home-based businesses represent 52% of that 27.9 million. Small businesses make up 99.7 percent of U.S. employer firms; 64 percent of net new private-sector jobs; 49.2 percent of private-sector employment; 42.9 percent of private-sector payroll; 46 percent of private-sector output; 43 percent of high-tech employment; 98 percent of firms exporting goods; and 33 percent of exporting value.

("Source")

But each year government, local, state and federal, pile more and costly regulations on small business, in spite of what the Trump Administration is trying to do by lowering taxes and rolling back regulations. Nevertheless, the regulation compliance obligations for small business, still grows, virtually by the day. Most small businesses are unaware of current law, proposed law, or new laws just passed by state legislatures.

The current ruling by the U. S. Supreme Court, to place all on-line retailers subject to state sales taxes from at least 45 states, could drive many small businesses out of business. Congress must act to exempt small businesses from this terrible decision, or the consequences could significantly affect our current economic growth.

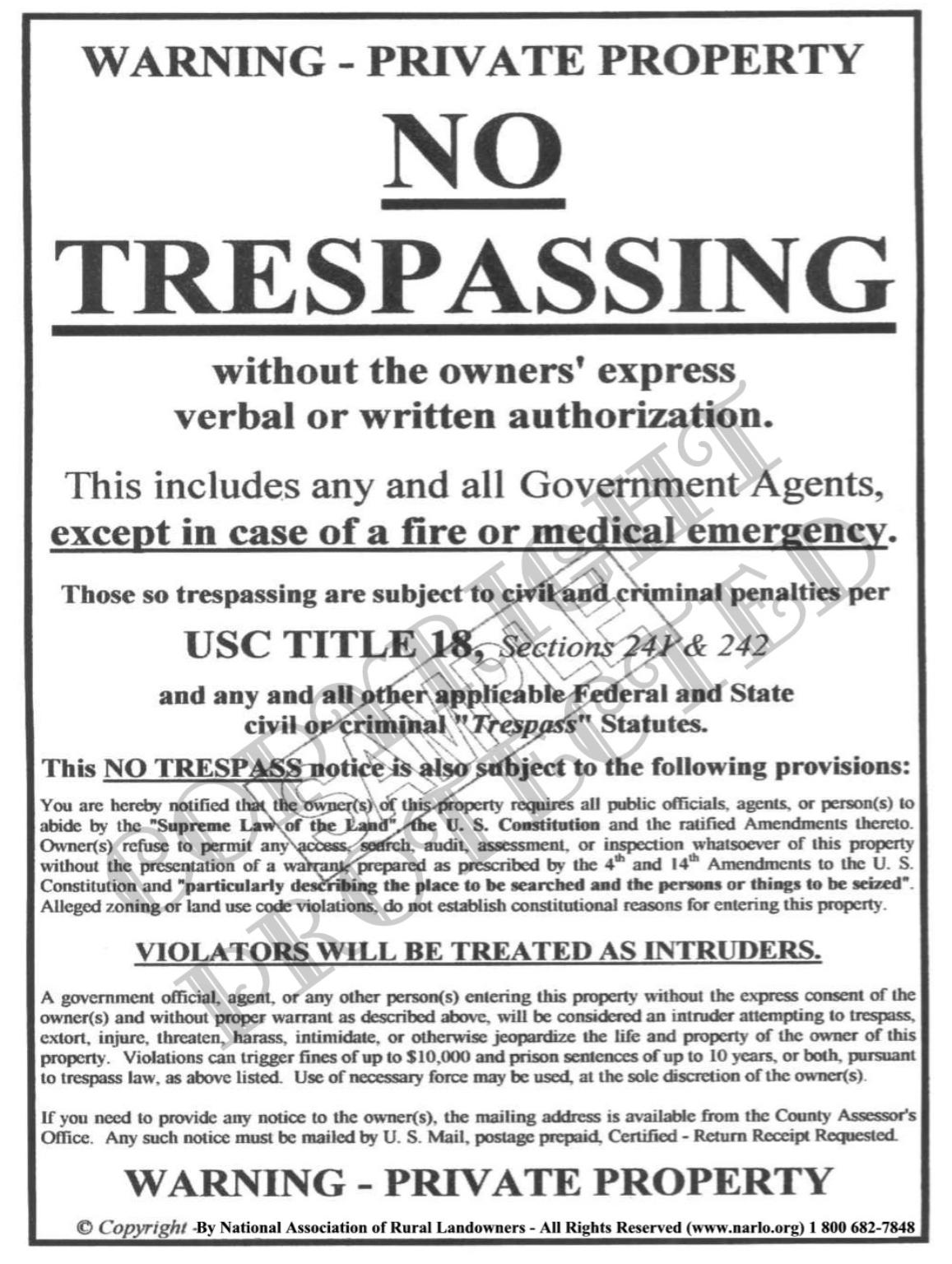

Ranches and farms are small businesses too. They are also being hit hard by local, state and federal land use and environmental regulations to the point of driving many small farms and ranches out of business. Who is fighting for the farmer and rancher? We are. (NARLO). If you are a farmer or rancher, it would be in your best interest to check out the products and services we provide rural landowners to help them fight government ordinances and abuse, and without a lawyer. We have powerful, legally intimidating, constitutional "no trespassing signs", a "rural landowner handbook" and an "Empowerment Package" that provides the history and foundation of our liberty, freedom and property rights and much more.

© Copyright January 2018 by the National Association of Rural Landowners - All rights reserved.